5 Key Trends Shaping the Bitcoin Market in 2024, daily news analysis

With the latest round of Bitcoin-focused developments, we can discern a few powerful trends reshaping the cryptocurrency landscape. Each news item sheds light on how institutional involvement, retail interest, and macroeconomic conditions are aligning to potentially fuel Bitcoin’s growth and adoption. Let’s break down each headline and analyze its implications on the market.

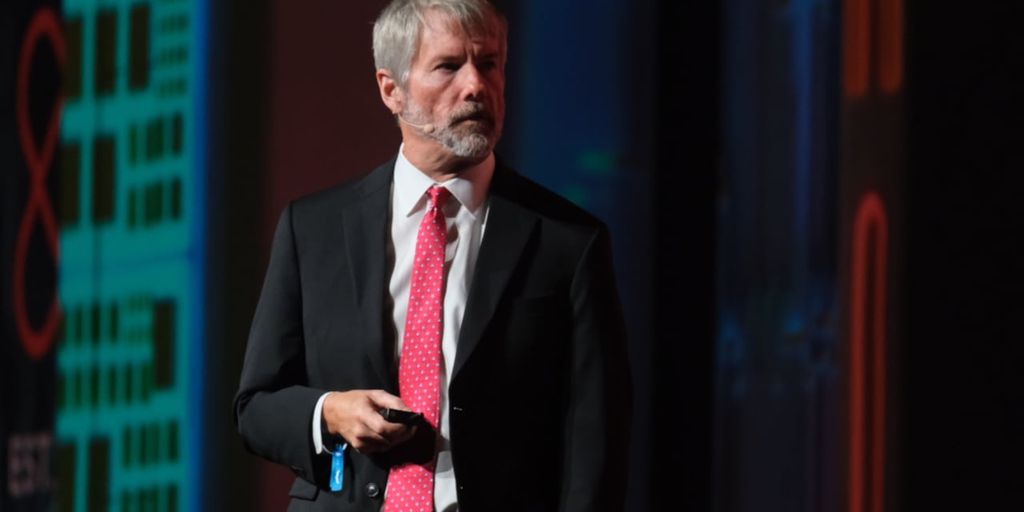

1. MicroStrategy’s $26 Billion Bitcoin Investment Outpaces IBM and Nike in Market Value

MicroStrategy’s substantial investment in Bitcoin, amounting to $26 billion, reflects a notable corporate trend of viewing Bitcoin as a strategic asset rather than a speculative play. CEO Michael Saylor’s commitment to Bitcoin has transformed MicroStrategy’s identity, aligning it closer to Bitcoin’s volatility than the predictable revenue streams typical of software firms. As a result, the company’s market value has now outpaced major brands like IBM and Nike, a testament to the perceived value and future potential of its Bitcoin holdings.

This bold stance by MicroStrategy sends a strong message to other corporations: Bitcoin is emerging as a legitimate alternative to cash reserves or traditional financial assets. If other companies adopt a similar approach, it could lead to a surge in demand for Bitcoin, further driving up its price. However, this strategy remains high-risk. Any significant downturn in Bitcoin’s value would heavily impact MicroStrategy’s market position and might deter other companies with lower risk tolerance.

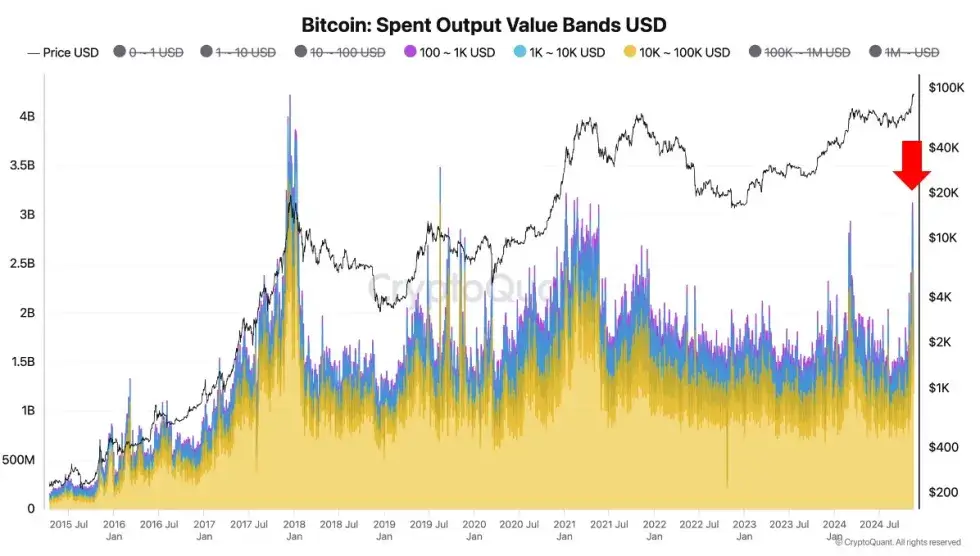

2. Bitcoin Transaction Volume Points to Growing Retail Investor Interest

Bitcoin’s recent uptick in transaction volume, largely from smaller, retail-driven transactions, indicates that everyday investors are back in the game. This return of retail interest, particularly after a period of market volatility, shows renewed confidence in Bitcoin’s long-term growth potential. Retail investors are typically less concerned with short-term fluctuations than institutional players, meaning their re-entry could bring some stability to the market.

The involvement of retail investors is crucial as it broadens Bitcoin’s user base, supporting liquidity and price resilience. Moreover, as more everyday investors buy in, Bitcoin’s adoption as a viable savings and investment vehicle grows. However, retail-driven markets can also be more susceptible to price swings since retail investors tend to be more reactive to sudden news. If market sentiment shifts quickly, it could lead to sharp fluctuations, but a sustained retail interest will likely support Bitcoin’s ongoing adoption and price stability.

3. The Debate Over a Strategic Bitcoin Reserve Without Congressional Approval

The idea of the U.S. government holding a strategic Bitcoin reserve is a fascinating proposition that, if realized, would be a landmark shift in the cryptocurrency’s journey toward mainstream recognition. Advocates argue that a Bitcoin reserve would strengthen the U.S.’s position in the digital economy, particularly as more nations explore digital assets and central bank digital currencies (CBDCs). However, executing this idea without congressional approval is legally contentious and may face significant opposition.

A federal Bitcoin reserve could potentially validate Bitcoin’s role as a store of value at a national level, sending shockwaves through global markets and encouraging other countries to explore similar options. Yet, even without immediate government action, this conversation has raised Bitcoin’s profile, positioning it as a strategic asset rather than merely a speculative one. If the proposal gains momentum, it could create an environment of competitive accumulation among nations, putting upward pressure on Bitcoin prices. However, the lack of legislative clarity on such a reserve may keep this idea in the conceptual phase for now.

4. Predictions Point to $100,000 Bitcoin as Market Sentiment Turns Bullish

The renewed prediction of a $100,000 Bitcoin value by market analysts has fueled bullish sentiment, with supporters pointing to the upcoming halving event and increased institutional adoption as key drivers. Historically, Bitcoin halving events, which occur approximately every four years, reduce the rate at which new Bitcoin is produced. This supply reduction typically aligns with price increases, as it introduces scarcity into the market. Institutional investments, greater regulatory clarity, and an expanding crypto infrastructure also contribute to the positive outlook.

While these projections are optimistic, reaching a $100,000 valuation would likely require sustained buying pressure from both institutional and retail investors. The psychological milestone of $100,000 could attract fresh investments and media attention, further propelling the market. However, high expectations can sometimes lead to volatile trading, as quick profit-taking and reactive sentiment often follow large price movements. Nevertheless, this price target serves as a beacon for many investors, reinforcing Bitcoin’s potential as a high-value asset in both the financial and tech sectors.

5. MicroStrategy Announces $1.75 Billion Convertible Notes Offering to Expand Bitcoin Holdings

In a strategic continuation of its Bitcoin-centric financial approach, MicroStrategy plans to raise $1.75 billion through a convertible notes offering to acquire more Bitcoin. This decision underscores CEO Michael Saylor’s unwavering belief in Bitcoin’s long-term value. By issuing convertible notes, MicroStrategy can attract investors who see potential upside in its stock, especially if Bitcoin’s value continues to climb. However, this financing approach carries risk, as it increases MicroStrategy’s debt obligations tied to a highly volatile asset.

For the broader market, this move highlights the potential of corporate-led Bitcoin accumulation. As MicroStrategy amasses larger Bitcoin holdings, other companies may be encouraged to explore similar options, driving up demand. However, reliance on debt to buy Bitcoin makes MicroStrategy heavily dependent on BTC’s price performance. Should Bitcoin’s value drop, it could place financial strain on the company and dampen enthusiasm for corporate Bitcoin investment. Nevertheless, this high-profile commitment by a public company reinforces the view of Bitcoin as a viable asset for institutional portfolios.

Final Market Outlook

The news items collectively underscore a shifting landscape where Bitcoin is gaining traction as a credible asset among corporations, retail investors, and even national-level strategists. MicroStrategy’s aggressive Bitcoin accumulation, coupled with growing retail interest and optimistic price predictions, suggests that Bitcoin is becoming a more established part of the global financial ecosystem. The proposal for a national Bitcoin reserve also highlights the currency’s strategic appeal, even if it remains a concept for now.

Key Takeaways:

- Institutional Adoption: MicroStrategy’s moves underscore a broader trend of corporate interest in Bitcoin, potentially leading to wider institutional adoption.

- Retail Engagement: The return of retail investors strengthens Bitcoin’s support base, increasing liquidity and stability.

- Global Positioning: Discussions around a national Bitcoin reserve and $100,000 price predictions signal Bitcoin’s elevated status as a store of value.

- Volatility Risks: These developments bring opportunities but also risks, especially if sudden changes in sentiment trigger market swings.

Conclusion:

Bitcoin’s trajectory appears optimistic, with a strong possibility of price appreciation driven by institutional backing, retail momentum, and broader acceptance as a strategic asset. However, these gains come with inherent volatility risks. If institutional and retail interest remains steady, Bitcoin could reach significant valuation milestones, further solidifying its role as a legitimate asset class.

- 26 Forums

- 1,469 Topics

- 1,742 Posts

- 2 Online

- 725 Members