Spot Bitcoin ETFs Witness Record Withdrawals Amid Declining CME Futures Premium

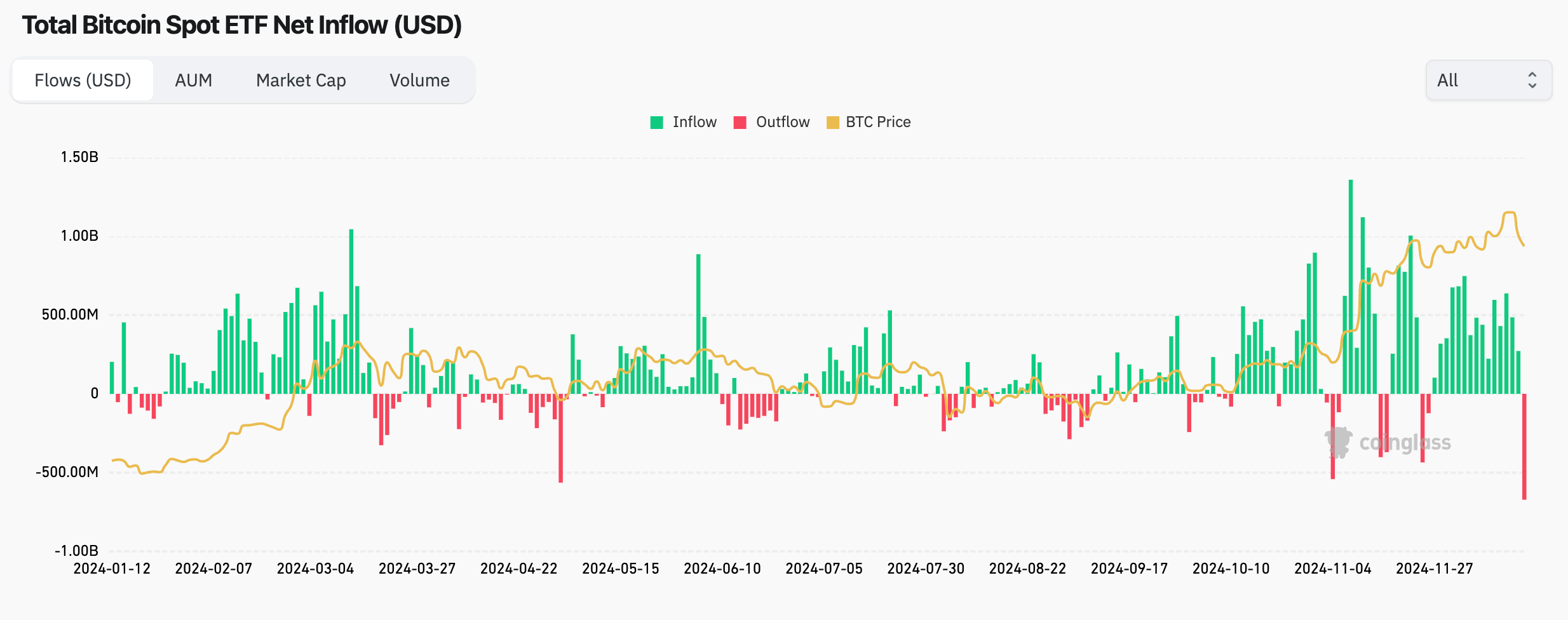

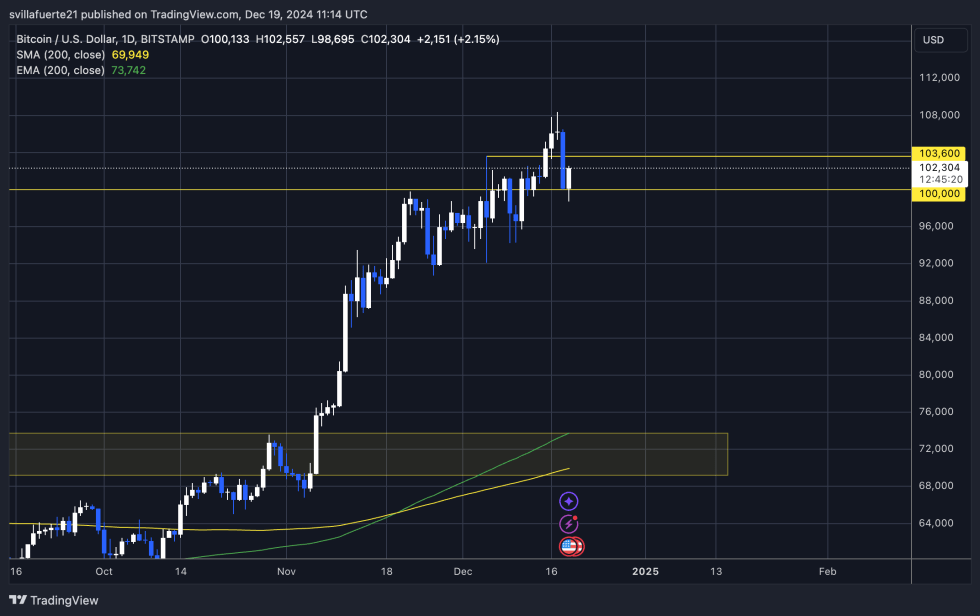

U.S. spot Bitcoin exchange-traded funds (ETFs) have experienced unprecedented single-day outflows, with $680 million withdrawn, ending a 15-day streak of positive capital inflows. Notable contributors to this withdrawal include Fidelity's FBTC, Grayscale's Bitcoin Mini Trust, and the ARKB ETF by Ark and 21Shares. This mass exodus coincided with Bitcoin's price dipping below $100,000, following remarks from Federal Reserve Chair Jerome Powell.

CME Futures Premium Indicates Weaker Demand

Simultaneously, the Chicago Mercantile Exchange (CME) Bitcoin futures market has shown signs of waning demand. The premium on CME Bitcoin futures contracts, which typically reflects investor optimism, has declined. Previously, CME front-month futures contracts traded at a significant premium of 18.7% annualized to the spot price, indicating bullish sentiment. However, recent data suggests a reduction in this premium, pointing to a potential decrease in institutional demand.

Market Implications

These concurrent trends suggest a cautious outlook among investors regarding Bitcoin's short-term performance. The substantial withdrawals from spot Bitcoin ETFs indicate profit-taking or a shift in investment strategies, possibly due to macroeconomic factors or regulatory concerns. The diminishing CME futures premium further supports the notion of tempered demand, as institutional investors reassess their positions in the Bitcoin market.

Long-Term Bitcoin Holders Offload 1 Million BTC Since September

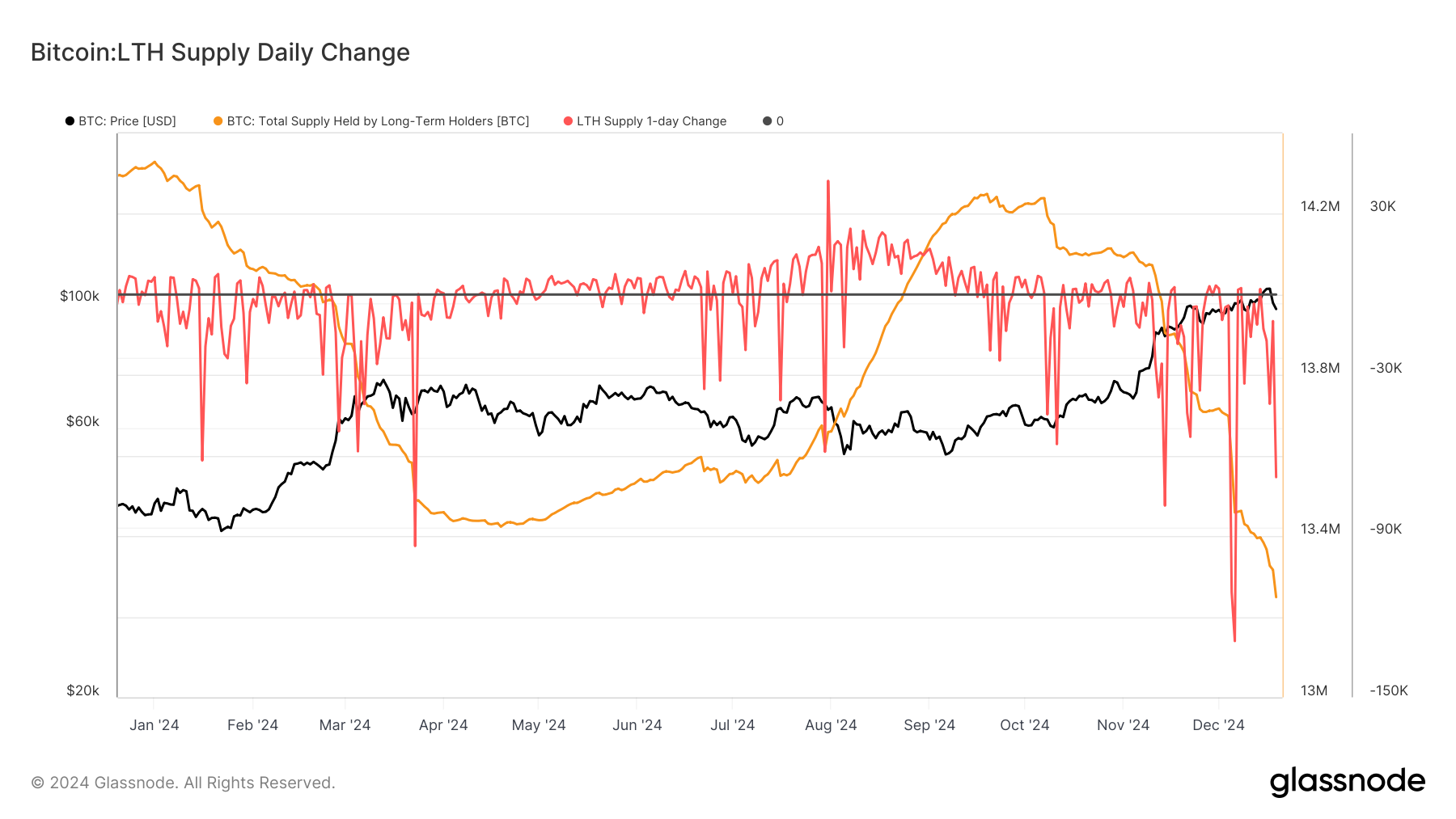

Recent data indicates that long-term Bitcoin holders (LTHs) have sold approximately 1 million BTC since September 2024, reducing their holdings from around 14.2 million to 13.2 million BTC.

Increased Selling Activity

On December 19, 2024, LTHs sold nearly 70,000 BTC, marking the fourth-largest single-day sell-off this year. This surge in selling aligns with Bitcoin's price reaching new highs, prompting profit-taking among investors who acquired BTC at lower prices.

Market Absorption

Despite significant sales from LTHs, the market has demonstrated resilience, with new demand absorbing the increased supply. Short-term holders (STHs) have accumulated over 1 million BTC during the same period, indicating sustained interest and confidence in Bitcoin's potential.

Implications for Bitcoin's Price

The redistribution of Bitcoin from LTHs to STHs suggests a dynamic market where profit-taking is balanced by new investments. While large-scale selling by LTHs can exert downward pressure on prices, the concurrent accumulation by STHs has helped maintain market stability.

Bitcoin Whale Transfers 72,000 BTC Held for Over 5 Years, Hinting at Market Shift

A significant movement has been observed in the Bitcoin market, where a whale—an entity holding a large amount of Bitcoin—has transferred 72,000 BTC that had remained dormant for 5 to 7 years. This substantial transfer has sparked discussions about its potential implications on the market and whether it signals a broader shift in investor sentiment or the onset of an altseason.

Potential Market Shift

The transfer of such a large amount of Bitcoin by a long-term holder may indicate a change in market dynamics. It could suggest that the holder anticipates a market downturn and is moving assets in preparation to sell, which might increase selling pressure and potentially lead to a decrease in Bitcoin's price. Alternatively, it could be a strategic move to reallocate assets or diversify investments.

Indicator of Altseason

Another perspective is that this transfer could signal the beginning of an altseason—a period when alternative cryptocurrencies (altcoins) experience a surge in value relative to Bitcoin. If large Bitcoin holders are moving their assets, it might indicate a shift in focus towards altcoins, suggesting that investors are seeking higher returns in other digital assets.

Market Implications

Such significant movements by Bitcoin whales can have notable effects on the cryptocurrency market. They can influence market sentiment, liquidity, and price volatility. Traders and investors often monitor these large transactions to gauge potential market trends and make informed decisions.

Stablecoin Demand Surges on Ethereum Layer 2 Networks

Recent developments indicate a significant surge in stablecoin demand on Ethereum Layer 2 networks, particularly on platforms like Polygon and Blast.

Polygon's Stablecoin Market Growth

Polygon, an Ethereum Layer 2 solution, has experienced a notable increase in its stablecoin market capitalization. Reports reveal that Polygon's stablecoin market cap has risen to $1.5 billion, marking a 19% quarter-over-quarter growth. Tether (USDT) leads this expansion, with its market cap on Polygon growing by 29% to $792 million, accounting for 53% of the total stablecoin market cap on the network. This growth is attributed to various developments, including trials by Sony Bank exploring stablecoin use on Polygon and plans by tech companies like Settlemint to develop stablecoins leveraging Polygon's infrastructure.

Blast Layer 2 Network's Rapid Adoption

The Blast Layer 2 network has also witnessed significant traction. Within hours of its launch, investors bridged over $30 million in ether and stablecoins to the platform, demonstrating strong demand for Layer 2 solutions that enhance transaction speed and reduce costs. Blast's design incentivizes users by offering yields on transferred ether and BLAST points, further driving user engagement.

Implications for the Crypto Ecosystem

The increasing demand for stablecoins on Ethereum Layer 2 networks underscores the growing importance of scalable solutions in the blockchain space. Layer 2 networks like Polygon and Blast address challenges related to speed, cost, and scalability, making them attractive for both developers and users. The surge in stablecoin adoption on these platforms reflects a broader trend towards efficient and cost-effective blockchain solutions, potentially influencing the future development of decentralized finance (DeFi) and other blockchain-based applications.

Brazilian Investors Show Growing Interest in Cryptocurrency Investments

Brazil has emerged as a significant player in the global cryptocurrency landscape, with a notable increase in both individual and institutional investments.

Individual Investor Growth

Recent data indicates that over 34.5 million Brazilians have invested in cryptocurrencies, with approximately 75% engaging in monthly purchases. This trend highlights a growing acceptance of digital assets among the general populace.

Institutional Investment Surge

Institutional interest in cryptocurrencies has also risen markedly. In late 2023, there was a 29.2% increase in large-scale transactions (over $1 million), followed by a 48.4% rise from Q4 2023 to Q1 2024. This uptick suggests that major financial entities are increasingly viewing digital assets as viable investment opportunities.

Stablecoin Adoption

Stablecoins have gained significant traction in Brazil, accounting for 70% of exchange flows and surpassing Bitcoin in transaction value. This preference is largely due to stablecoins' ability to provide exposure to the U.S. dollar, offering a hedge against local currency volatility.

Regulatory Environment

The Brazilian government has taken steps to regulate the cryptocurrency market. In December 2022, Brazil established a licensing regime for virtual asset service providers, aiming to legalize crypto as a payment method. This regulatory framework seeks to balance innovation with consumer protection, fostering a more secure environment for crypto transactions.

Market Implications

The increasing adoption of cryptocurrencies in Brazil reflects a broader trend towards digital finance in Latin America. As both individual and institutional investors continue to engage with digital assets, Brazil's role in the global crypto economy is poised to expand further.

The U.S. Securities and Exchange Commission (SEC) has approved the first dual Bitcoin-Ethereum exchange-traded funds (ETFs) from Hashdex and Franklin Templeton.

SEC Approves First Hybrid Bitcoin-Ethereum ETFs from Hashdex and Franklin Templeton

- Hashdex Nasdaq Crypto Index US ETF: This ETF will be listed on Nasdaq and offers investors exposure to both Bitcoin and Ethereum.

Franklin Crypto Index ETF: Set to trade on the Cboe BZX Exchange, this ETF provides a combined investment in Bitcoin and Ethereum.

Both ETFs are market cap-weighted, featuring an approximate 80/20 split between Bitcoin and Ethereum. They are scheduled to launch in January 2025.

Implications for the Crypto Market

The approval of these hybrid ETFs signifies a notable advancement in the cryptocurrency investment landscape, offering investors diversified exposure to the two leading digital assets through regulated financial instruments. This development is expected to enhance institutional participation and could positively influence market sentiment.

Market Context

The SEC's decision comes amid recent market volatility, with Bitcoin prices experiencing fluctuations below $96,000 and Ethereum trading around $3,440.

El Salvador to Shut or Sell Chivo Wallet as Part of $3.5 Billion IMF Deal

El Salvador has agreed to modify its Bitcoin policies as part of a $1.4 billion loan agreement with the International Monetary Fund (IMF). Key changes include making Bitcoin acceptance voluntary for businesses, limiting public sector involvement in Bitcoin activities, and discontinuing or selling the government-operated Chivo wallet.

Despite these adjustments, Bitcoin will remain legal tender in El Salvador. The government plans to continue purchasing Bitcoin for its reserves, potentially at an accelerated pace. Currently, El Salvador holds approximately 5,968.77 BTC, valued at around $600 million.

These policy changes aim to address concerns raised by the IMF regarding financial stability and consumer protection. By making Bitcoin acceptance optional and reducing public sector participation, the government seeks to balance its commitment to cryptocurrency with the requirements of the IMF loan agreement.

Bhutan Expands Bitcoin Mining as a Strategic Economic Initiative

Bhutan, the Himalayan kingdom renowned for its Gross National Happiness philosophy, has strategically embraced Bitcoin mining as a catalyst for economic development. Leveraging its abundant hydroelectric resources, Bhutan has established itself as a significant player in the cryptocurrency landscape.

Strategic Bitcoin Mining Initiatives

Since 2019, Bhutan's state-owned investment arm, Druk Holding and Investments (DHI), has been utilizing the nation's green hydropower to mine Bitcoin. This initiative has enabled Bhutan to accumulate substantial Bitcoin reserves, positioning the country among the top global holders of the cryptocurrency.

Economic Impact and Future Prospects

The revenue generated from Bitcoin mining has diversified Bhutan's economy, traditionally reliant on agriculture and hydropower exports. The government plans to expand its Bitcoin mining capacity to 600 megawatts by 2025, in partnership with Bitdeer, a leading Nasdaq-listed technology company. This expansion is expected to further enhance the nation's economic growth and technological advancement.

Global Standing in Cryptocurrency Holdings

As of November 2024, Bhutan holds approximately 12,206 BTC, valued at over $1 billion, ranking it fifth among countries with significant Bitcoin holdings. This substantial reserve underscores Bhutan's commitment to integrating cryptocurrency into its economic framework.

Crypto Liquidation Hits $1.5 Billion as Bitcoin, Ethereum, and XRP Face Price Dips

The cryptocurrency market recently experienced a significant downturn, with over $1.5 billion in liquidations across various digital assets. This event was marked by a sharp decline in Bitcoin's price, which fell to an intraday low of approximately $94,100 before recovering to around $97,800.

The majority of these liquidations were long positions, accounting for approximately $1.38 billion, while short positions comprised about $136.7 million. Ethereum and other major cryptocurrencies also faced substantial losses during this period.

This market volatility underscores the risks associated with leveraged trading in the cryptocurrency space. Investors are advised to exercise caution and consider the potential for rapid price fluctuations when engaging in such activities.

Key Takeaways

- Spot Bitcoin ETFs Face Challenges:

Record withdrawals from spot Bitcoin ETFs and a declining CME futures premium signal weaker institutional demand, reflecting changing market dynamics. - Long-Term Bitcoin Holders Liquidate Significant Holdings:

The sale of 1 million BTC by long-term holders since September underscores shifts in market sentiment and strategies among seasoned investors. - Bitcoin Whale Activity Indicates Market Transition:

The transfer of 72,000 BTC held for over five years suggests a potential market shift or the onset of an altseason as large players reposition. - Ethereum Layer 2 Networks See Rising Stablecoin Demand:

Layer 2 solutions on Ethereum are driving stablecoin adoption, emphasizing scalability and cost-efficiency for DeFi and payment applications. - Brazilian Interest in Cryptocurrency Investments Grows:

Brazil's investors show increased enthusiasm for crypto assets, reflecting a regional trend toward digital asset adoption in Latin America. - SEC Approves Bitcoin-Ethereum Hybrid ETFs:

The U.S. SEC’s approval of dual Bitcoin-Ethereum ETFs from Hashdex and Franklin Templeton marks a milestone in diversified crypto investment opportunities. - El Salvador Alters Bitcoin Policies for IMF Deal:

El Salvador’s decision to shut or sell its Chivo wallet under the IMF deal showcases the complexities of balancing crypto adoption with global financial expectations. - Bhutan Embraces Bitcoin for Economic Growth:

Bhutan’s strategic expansion of Bitcoin mining leverages its hydroelectric resources, showcasing a unique path to financial and technological innovation. - Crypto Market Liquidations Hit $1.5 Billion:

Major market corrections led to significant liquidations across Bitcoin, Ethereum, and XRP, highlighting the risks of leveraged trading in volatile markets.