From the rapid growth of stablecoins surpassing $200 billion to Vancouver's bold Bitcoin adoption initiative, the narrative reflects a dynamic shift in digital finance. Key highlights include the evolving role of AI in blockchain, advances in DeFi interoperability, Bitcoin’s record-breaking rally, and changing market sentiments. With major players like Standard Chartered and Frax Finance leading innovations, the crypto ecosystem continues to redefine global finance, bridging the gap between traditional systems and decentralized technologies. Discover how these pivotal stories are driving the next chapter in the crypto revolution.

1. Opening Doors for Banks Under a Trump Administration

The re-election of Donald Trump and his administration’s potential for easing banking regulations has drawn both excitement and skepticism. Proponents argue that deregulation can lead to a surge in banking sector mergers and acquisitions, enhancing competitiveness and growth opportunities. Critics, however, warn of the potential systemic risks, as loosening oversight has historically led to economic instability, notably during the 2008 financial crisis.

This anticipated deregulatory shift also raises questions about the U.S.’s global economic positioning. While the removal of certain restrictions may empower domestic financial institutions, it could also erode trust in the financial system’s resilience, especially in times of economic stress. Balancing growth with stability will be a key challenge in this scenario.

Impact on Crypto:

A more deregulated banking environment could indirectly benefit cryptocurrencies by fostering innovation in financial technologies. As traditional banks seek to remain competitive, partnerships with blockchain and crypto firms could increase, bridging the gap between decentralized and traditional finance.

2. Stablecoin Market Cap Hits $200B Milestone, Could Double in 2025 as Adoption Accelerates

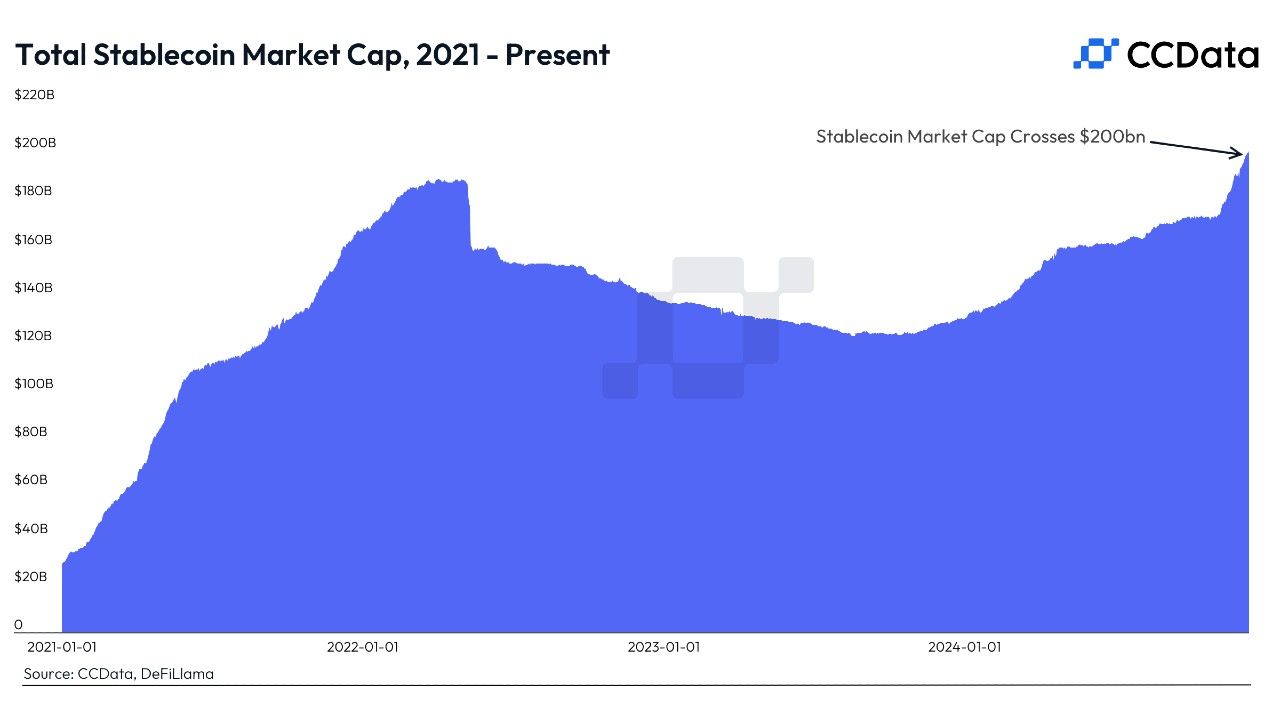

The stablecoin market reaching $200 billion highlights its integral role in crypto ecosystems and beyond. Tether (USDT) and Circle’s USDC lead the pack, with the market expected to grow to $400 billion by 2025. Drivers include clearer regulations, adoption by fintech firms, and the introduction of stablecoin projects like PayPal’s PYUSD. Stablecoins are increasingly used for remittances, payments, and liquidity management.

This growth underscores their potential to serve as a bridge between fiat and digital economies. However, concerns about over-centralization and the concentration of dominance by a few issuers remain critical. These issues need to be addressed to ensure the sustainable expansion of the stablecoin ecosystem.

Impact on Crypto:

The stablecoin boom boosts liquidity in the cryptocurrency market, allowing for smoother transactions and greater participation. As stablecoins grow, they provide the foundation for broader adoption of crypto assets, increasing the ecosystem's stability and attractiveness to institutional investors.

3. Vancouver City Council Passes Pro-Bitcoin Motion Citing Fiat Challenges

Vancouver’s initiative to explore Bitcoin integration represents a significant leap in municipal adoption of cryptocurrencies. The motion includes accepting taxes and fees in Bitcoin and exploring reserves held in BTC. This aligns the city with progressive approaches to hedging against inflation and fiat volatility.

While the motion is ambitious, it also faces challenges. Bitcoin’s environmental footprint and price volatility could impede implementation. However, successful execution could set a precedent for other cities globally, signaling a broader acceptance of cryptocurrencies as part of public financial management.

Impact on Crypto:

If successful, Vancouver’s move could ignite a trend of Bitcoin adoption among other cities and institutions, enhancing Bitcoin’s legitimacy as a reserve and payment asset. It also strengthens the narrative of crypto as a hedge against inflation and fiat instability.

4. Will Bitcoin Price Hit New All-Time High Heading into FOMC?

Bitcoin’s recent rally to $103,900 comes amid optimism over potential interest rate cuts and favorable inflation data. Historically, Bitcoin prices surge following FOMC meetings, with investors anticipating easier monetary policies as a boon for risk assets like cryptocurrencies.

However, Bitcoin’s notorious volatility remains a concern. After its peak, prices corrected to $94,100, resulting in liquidations exceeding $1.7 billion. This underscores the fragility of the market despite bullish trends.

Impact on Crypto:

A dovish FOMC could pave the way for more capital inflows into cryptocurrencies, further driving Bitcoin and altcoin prices upward. Yet, volatility remains a significant hurdle for wider adoption and stability in the market.

5. Blockchain’s Interoperability Revolution: The Role of Orchestration in Enhancing DeFi Platforms

Cross-chain orchestration is transforming decentralized finance (DeFi) by connecting isolated blockchain networks. Solutions like Agoric’s Orchestration API enable seamless interactions across chains, solving liquidity fragmentation issues and simplifying user experiences. These tools are pivotal for a unified DeFi ecosystem.

By promoting more efficient liquidity management, cross-chain orchestration can also drive innovation. Developers and users alike benefit from an interconnected financial landscape, fostering the growth of multi-chain decentralized applications (dApps).

Impact on Crypto:

As interoperability becomes a reality, it increases the usability and attractiveness of DeFi platforms, drawing more participants into the crypto market. It positions DeFi as a competitive alternative to traditional financial systems, enhancing the sector's long-term viability.

6. Frax Finance Working on Tech to Integrate AI and Blockchain

Frax Finance’s initiatives to merge AI with blockchain aim to redefine DeFi innovation. Collaborations like its NEAR Protocol partnership highlight the potential of leveraging AI for scalability and efficiency. Products like frxNEAR represent new use cases for blockchain technology, pushing boundaries in DeFi.

Additionally, Frax’s ongoing expansion into multi-chain ecosystems demonstrates its commitment to interoperability. By integrating AI into its blockchain infrastructure, Frax Finance is poised to create intelligent, adaptive financial systems tailored to user needs.

Impact on Crypto:

AI integration could usher in a new era for cryptocurrencies by enhancing efficiency and user experience in DeFi. Such developments may also attract tech-savvy investors, broadening the crypto market’s appeal.

7. Market Sentiment Shifts to Extreme Greed

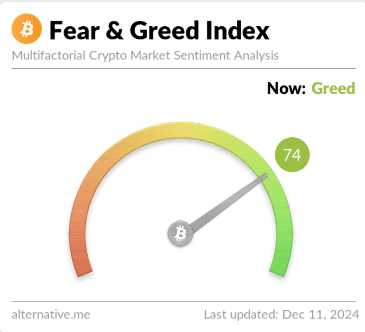

The Crypto Fear and Greed Index hitting “Extreme Greed” signals high investor confidence, driven by Bitcoin’s rally to $103,900. However, such exuberance often precedes heightened volatility, as evidenced by recent liquidations totaling $1.71 billion after Bitcoin corrected to $94,100.

This sentiment-driven market dynamic emphasizes the cyclical nature of crypto investing, where extreme optimism can quickly turn into caution or panic. It underscores the importance of balanced trading strategies.

Impact on Crypto:

Extreme greed fuels short-term price surges but increases the likelihood of sharp corrections. While positive for trading volumes, it creates an unstable environment that can deter long-term investors.

8. Standard Chartered to Manage Paxos Stablecoins Issued Outside the U.S.

Standard Chartered’s partnership with Paxos marks a major development in stablecoin management. By handling reserves for Paxos-issued stablecoins outside the U.S., such as in Singapore and the UAE, the bank ensures operational excellence and regulatory compliance.

This collaboration enhances trust in stablecoins like USDG and USDL, which are backed by liquid U.S. government securities. It also highlights the growing synergy between traditional financial institutions and blockchain technology.

Impact on Crypto:

Increased institutional participation in stablecoin management reinforces their reliability, attracting more users to blockchain ecosystems. This strengthens stablecoins as a cornerstone of the digital economy, facilitating growth in global crypto adoption.

Key Takeaways

- Potential Deregulation in U.S. Banking: Trump’s re-election could lead to relaxed banking regulations, fostering growth but raising concerns about financial stability. Crypto markets may benefit from increased innovation and partnerships with traditional banks.

- Stablecoin Market Growth: The $200 billion milestone signals strong adoption, with projections of $400 billion by 2025. Stablecoins continue to serve as a crucial bridge between traditional finance and crypto.

- Vancouver’s Pro-Bitcoin Stance: By exploring Bitcoin integration, Vancouver highlights a growing municipal interest in crypto adoption, potentially inspiring global trends.

- Bitcoin’s Bullish Momentum: Optimism around FOMC policies is driving Bitcoin prices upward, but volatility persists, requiring cautious investor approaches.

- DeFi Interoperability: Cross-chain orchestration is unifying fragmented ecosystems, making DeFi more accessible and efficient, boosting user adoption.

- AI Meets Blockchain: Frax Finance’s innovations showcase how AI integration can enhance DeFi platforms, improving scalability and user experiences.

- Market Sentiment Peaks: Extreme greed in the market drives Bitcoin rallies but also increases the risk of sharp corrections, highlighting the need for strategic trading.

- Institutional Backing for Stablecoins: Standard Chartered’s role in managing Paxos stablecoins solidifies institutional trust, enhancing their appeal and utility in global markets.