1. XRP Futures OI Hits $2.5B as Ripple Whales Accumulate Over 250M Coins

The surge in XRP’s futures open interest (OI) to $2.5 billion demonstrates growing speculative activity and trader confidence in the asset. Simultaneously, whale investors buying over 250 million XRP underscores their bullish sentiment, often a harbinger of future price growth. However, such concentrated speculative and institutional activity may heighten market volatility.

Impact:

The increased futures activity could lead to sharp price movements in XRP, creating opportunities for short-term traders but also posing risks for those caught in sudden swings. Whale accumulation could provide a solid floor for prices, signaling longer-term growth potential.

2. Bitcoin Whale Accumulation Hints at $100K Milestone

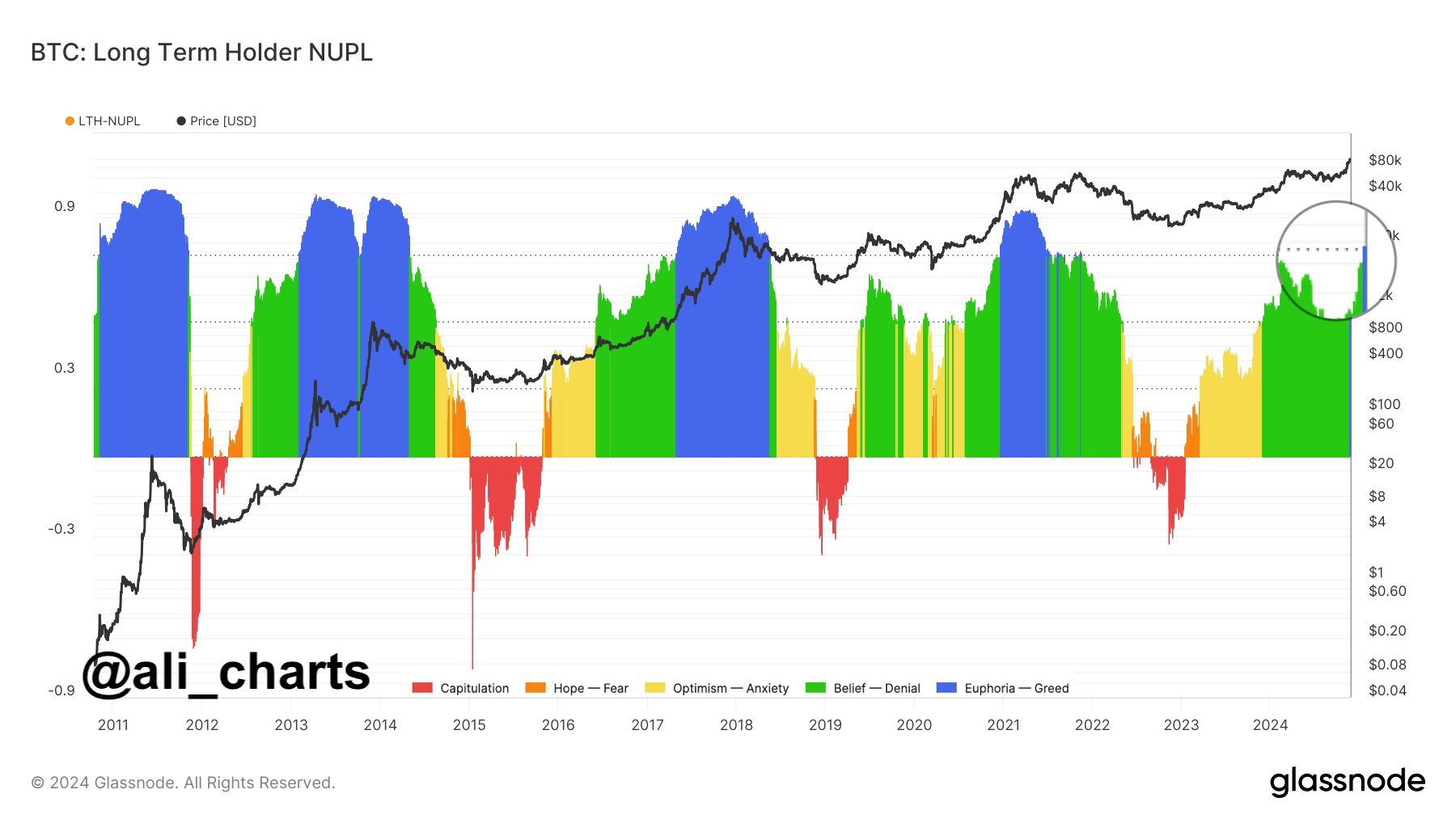

Bitcoin whale activity is intensifying, with major holders withdrawing over $107 million worth of BTC from Binance and a broader accumulation trend among 458,000 addresses. Technical indicators, such as the bullish SuperTrend and Bitcoin’s breakout above resistance levels, bolster optimism for reaching $100K. Yet, historical patterns of market “greed” suggest possible corrections before significant peaks.

Impact:

The accumulation signals strong long-term confidence, potentially paving the way for further price appreciation. However, the cautionary note on market greed indicates that a steady upward trajectory may be accompanied by intermittent corrections, requiring careful timing for investors.

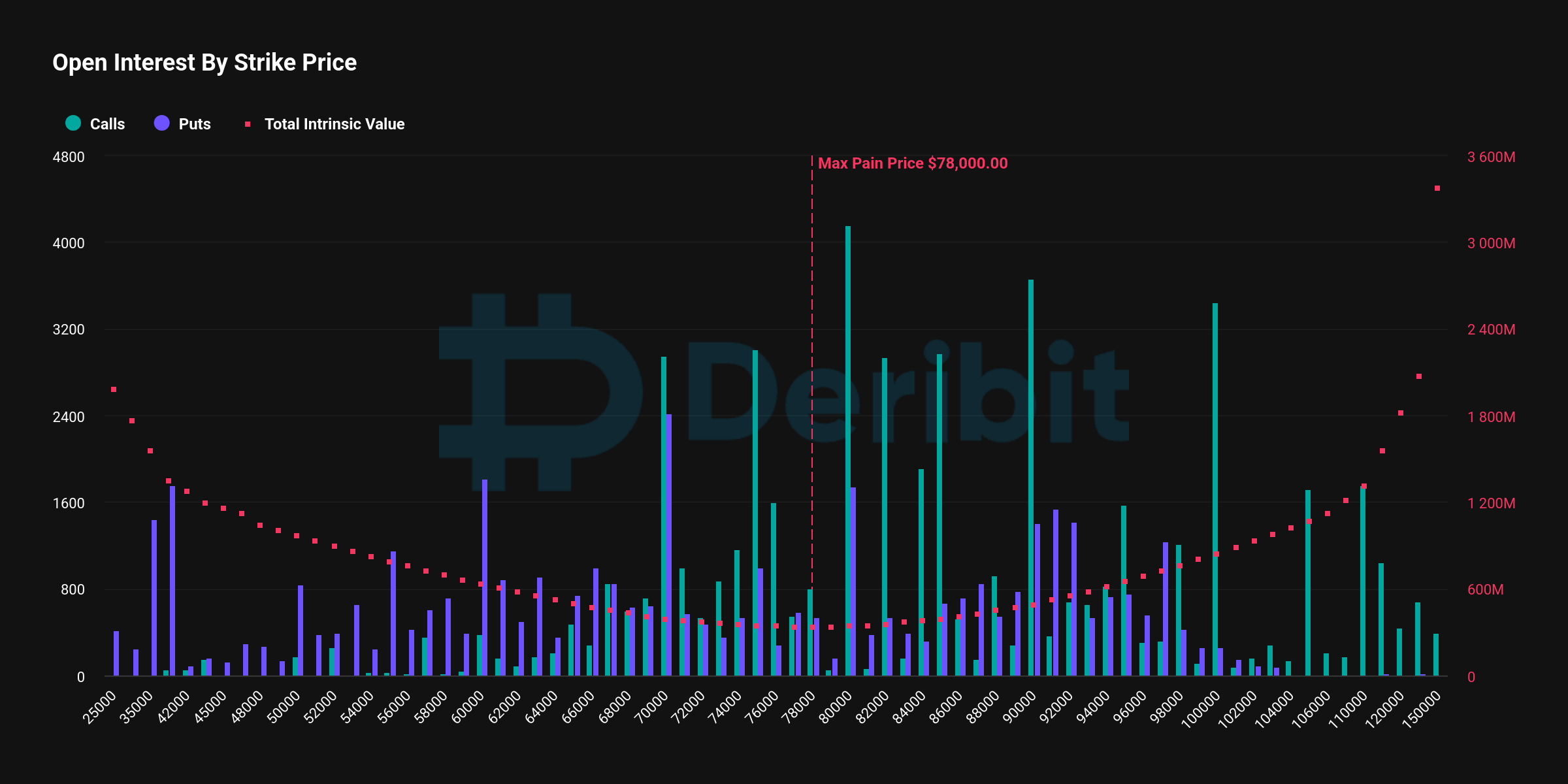

3. $9B in Bitcoin Options Expire Amid Post-Thanksgiving Volatility

The upcoming expiration of $9 billion in Bitcoin options contracts on Friday has traders bracing for heightened volatility. Historically, such expirations have led to sudden price swings as positions are settled. Coupled with lower trading volumes in the post-Thanksgiving period, this event may amplify market turbulence.

Impact:

Traders could see dramatic price movements as contracts expire, impacting both spot and futures markets. While this presents an opportunity for strategic trading, it also poses risks for unprepared investors. Increased volatility may provide liquidity for longer-term accumulation.

4. Bitcoin Recovers Near $98K Amid $500M in Liquidations

Bitcoin saw sharp fluctuations over the weekend, dropping to $95,800 before rebounding to $98,000. This volatility led to nearly $500 million in liquidations across long and short positions. Factors such as increasing demand for U.S.-listed Bitcoin ETFs and expectations of regulatory changes are supporting sentiment despite the price swings.

Impact:

The liquidation data reflects both the risks and opportunities in a volatile market. The resilience in demand from institutions and retail traders may stabilize prices, but the heightened activity in derivatives markets could fuel further swings, making strategic planning essential.

Key Takeaways

- XRP’s bullish sentiment is reinforced by whale accumulation and rising futures interest, but heightened speculative activity could lead to volatility.

- Bitcoin’s $100K ambitions are supported by whale behavior and strong technical indicators, yet history suggests corrections may precede major milestones.

- The $9B Bitcoin options expiry could create significant volatility, presenting opportunities for informed traders while warning of potential price swings.

- Bitcoin’s rebound near $98K shows resilience, with institutional interest and regulatory hopes driving optimism, but derivatives-driven volatility remains a challenge.