The cryptocurrency market has been buzzing with significant developments. Here’s a detailed analysis of each news event, its implications, and actionable takeaways for investors and enthusiasts.

1. XRP Rally Sees Record Profit-Taking as Ripple Invests in Bitwise XRP ETF

Ripple Labs’ decision to invest in Bitwise’s rebranded Physical XRP Exchange-Traded Product (ETP) marks a significant move towards integrating XRP with institutional markets. Bitwise has rebranded the product under the ticker GXRP and is regulated by German financial authorities. This step aligns with Ripple’s broader strategy to push XRP adoption in regulated financial ecosystems.

Despite this positive development, the rally in XRP prices has led to record levels of profit-taking among traders. This profit realization suggests that while investor sentiment around XRP remains optimistic, there is still caution about sustaining higher price levels in the short term.

Overall, the investment by Ripple signals long-term confidence in XRP’s utility across cross-border payments, DeFi, and tokenization. The profit-taking, however, reflects the balance of optimism and caution typical of volatile crypto markets.

Market Impact:

Institutional support strengthens XRP’s legitimacy and adoption.

Profit-taking may slow the rally temporarily but highlights healthy market activity.

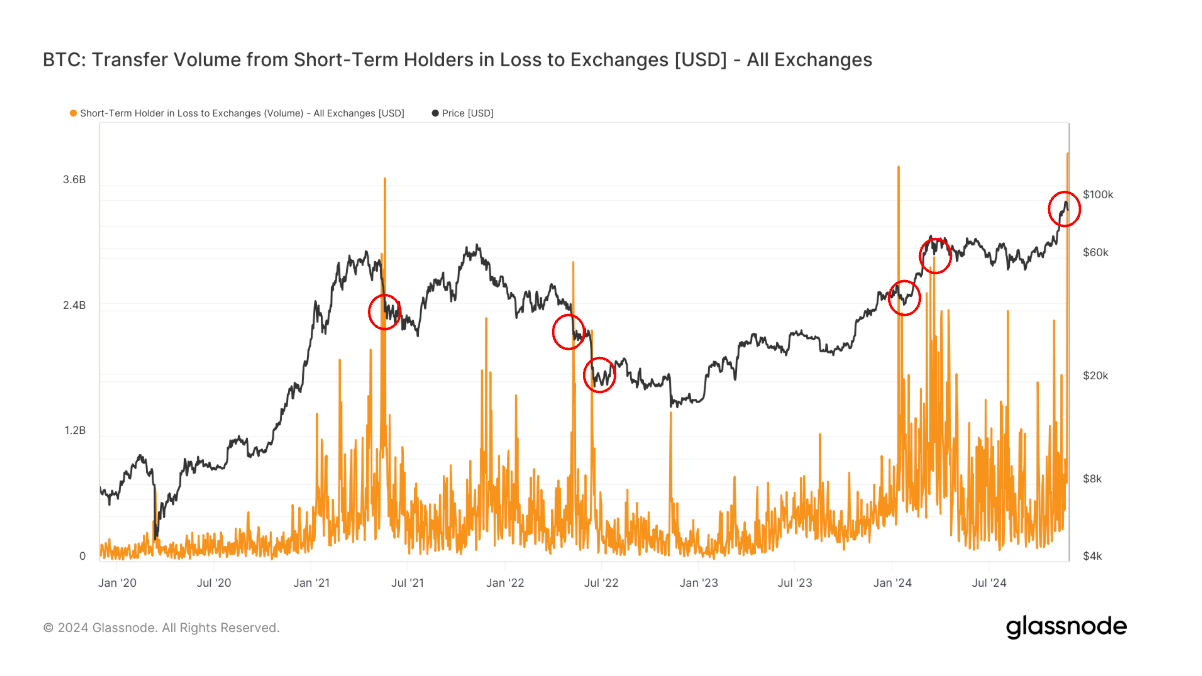

2. Short-Term Bitcoin Holders Move $8B to Exchanges

Glassnode’s data indicates that short-term Bitcoin holders recently moved nearly $8 billion worth of BTC to exchanges, with the majority of these trades occurring at a loss. Historically, such capitulation events often signal a local price bottom, as weaker hands exit the market while long-term holders accumulate.

This movement follows Bitcoin’s recent price volatility, which saw it decline from $100,000 to around $90,000. Short-term traders were quick to liquidate as the market dipped, while long-term investors held firm, reflecting contrasting sentiments between these groups.

Such patterns, which are not uncommon in Bitcoin’s history, usually set the stage for price stabilization and potential rebounds. Investors should interpret these signals as indicative of a market recalibration rather than a full-blown downturn.

Market Impact:

Short-term volatility heightened by panic selling.

Long-term holders maintain confidence, which stabilizes market sentiment.

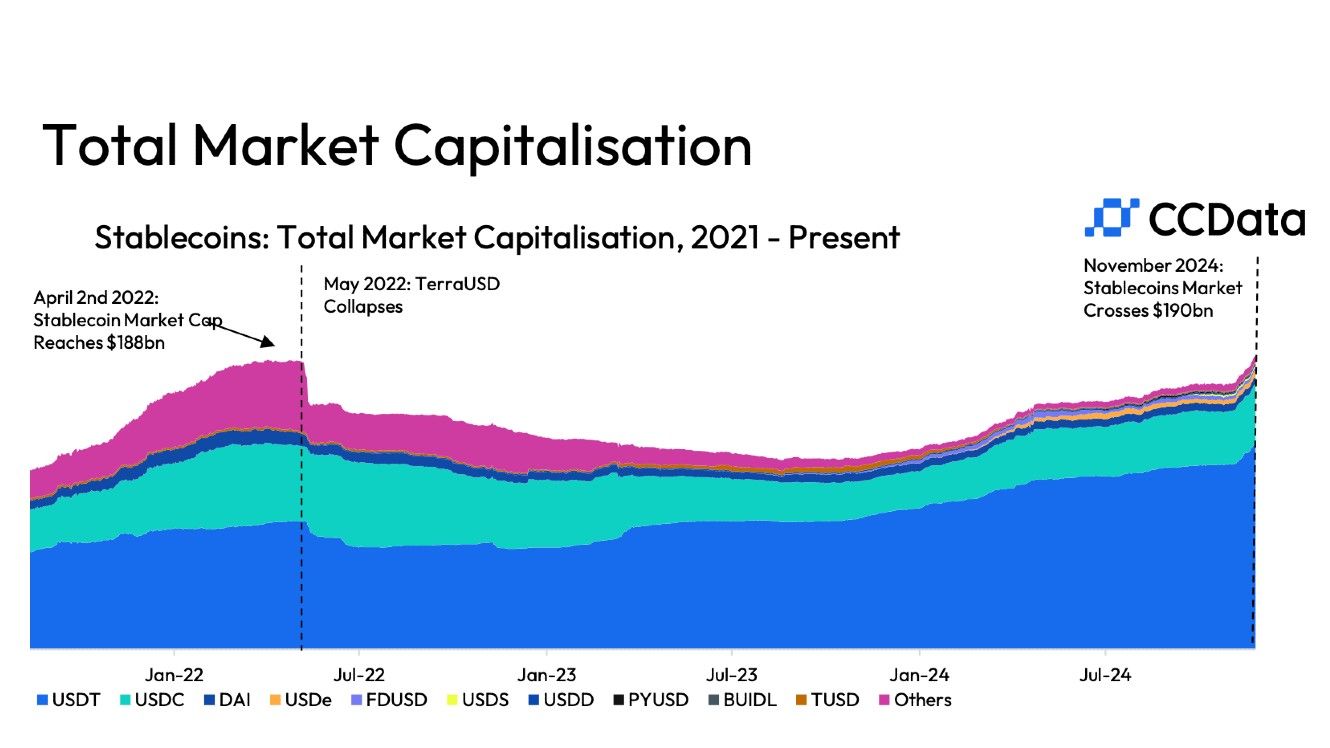

3. Stablecoin Market Hits Record $190B Market Cap

The total market capitalization of stablecoins has surpassed $190 billion, recovering to levels last seen before the TerraUSD collapse. Tether (USDT) leads the pack with a dominant $132 billion share, followed by USD Coin (USDC) and Dai (DAI).

This resurgence underscores the critical role stablecoins play in providing liquidity, stability, and utility within the broader cryptocurrency ecosystem. The rise reflects increased adoption of stablecoins for decentralized finance (DeFi) and cross-border payments, demonstrating their importance as hedging tools against market volatility.

The recovery highlights growing confidence in stablecoins, even as the crypto industry grapples with challenges. As stablecoins continue to bridge traditional and digital finance, their role in fostering wider adoption of cryptocurrencies becomes even more pronounced.

Market Impact:

Stablecoins bolster liquidity in DeFi and remittance use cases.

Renewed trust in stablecoin resilience post-Terra crash enhances ecosystem stability.

4. Fantom Price Rallies 63% Amid Sonic Upgrade Hype

Fantom’s price surge of 63% in just one week reflects growing excitement around the platform’s upcoming “Sonic” upgrade. The upgrade aims to enhance Fantom’s performance in the DeFi space, which peaked with $15 billion in TVL during 2021 but has since dropped significantly.

The Sonic upgrade promises to improve scalability and usability, attracting new projects and users to the ecosystem. Analysts have set ambitious price targets, with long-term projections suggesting a potential rally to $15, provided the upgrade delivers on its promises and market sentiment remains favorable.

This resurgence marks Fantom’s determination to reclaim its position as a leading DeFi platform. Investors should monitor the platform’s progress as the upgrade rolls out, as its success could drive sustained growth in FTM’s valuation.

Market Impact:

Anticipation of upgrades boosts short-term investor confidence.

Long-term growth contingent on successful implementation of Sonic.

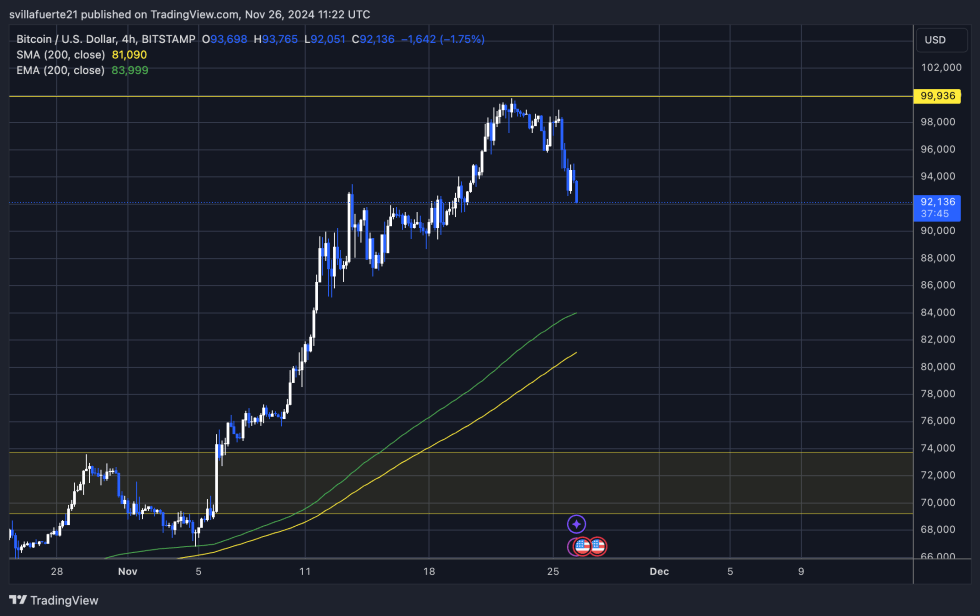

5. Bitcoin Price Drops 8% After Nearing $100K

Bitcoin recently experienced an 8% pullback after reaching a high of $99,800, primarily due to profit-taking by long-term holders. Approximately $60 billion worth of Bitcoin has been distributed by these investors over the past month, marking the heaviest profit-taking of the cycle.

Despite the decline, options market data suggests balanced sentiment, with probabilities favoring both upward and downward movements in the near term. Analysts point out that such corrections are not unusual, especially during high-volatility bull markets.

This correction could pave the way for a healthier rally, as the market digests recent gains and builds momentum for another push toward $100,000. Long-term investors remain optimistic, viewing these dips as opportunities to accumulate.

Market Impact:

Temporary dip fueled by heavy profit-taking.

Options market signals cautious optimism for eventual recovery.

6. Binance Expands Support for SHIB, HBAR, and APE

Binance’s decision to add new trading pairs and enable trading bot services for Shiba Inu, Hedera, and ApeCoin has sparked price rallies for these tokens. By offering increased liquidity and automated trading tools, Binance is positioning itself as a leader in supporting altcoin markets.

Following the announcement, SHIB, HBAR, and APE saw gains of 4%, 8%, and 3%, respectively. These price movements indicate strong investor interest and the potential for sustained momentum as Binance continues to expand its offerings.

The exchange’s initiatives highlight the growing appeal of altcoins and their role in diversifying crypto portfolios. Enhanced accessibility to these tokens further fuels their adoption.

Market Impact:

Increased trading volumes drive short-term price gains.

Binance’s support strengthens altcoin credibility and liquidity.

7. Bitcoin Can Experience 30% Declines During Bull Markets

Analysts emphasize that sharp corrections, even up to 30%, are common in Bitcoin’s price history, even during bull runs. These dips serve as necessary consolidation phases that shake out weaker hands and prepare the market for sustained growth.

Such patterns have been observed during previous cycles, including Bitcoin’s surge from $17,000 to $64,000 in 2021. The latest 8% decline aligns with this trend, reminding investors to focus on long-term trajectories rather than short-term volatility.

This insight highlights the importance of managing risk and avoiding panic-selling during market downturns, as corrections often present valuable entry points for strategic investors.

Market Impact:

Reinforces Bitcoin’s resilience amid corrections.

Encourages long-term investment strategies over short-term speculation.

8. Tornado Cash Sanctions Overturned by U.S. Appeals Court

The U.S. Appeals Court’s ruling against Tornado Cash sanctions marks a major victory for decentralized technologies. The court determined that sanctioning software, rather than its misuse, exceeded OFAC’s authority, setting a precedent for future crypto regulations.

This decision highlights the need for nuanced regulatory approaches that address illicit activities without stifling innovation. It also reflects the judiciary’s understanding of the unique challenges posed by decentralized protocols.

As privacy-focused tools like Tornado Cash face regulatory scrutiny, this ruling underscores the balance required between security and innovation in the evolving crypto landscape.

Market Impact:

Positive sentiment for decentralized technologies.

Highlights the importance of clear, targeted regulations.

9. Donald Trump Plans to Give CFTC Oversight of Crypto

The Trump administration’s proposal to expand the CFTC’s authority over cryptocurrencies represents a significant shift in U.S. regulatory policy. This move aims to provide a more consistent framework for digital asset oversight while addressing industry complaints about the SEC’s approach.

Crypto proponents view this as a positive development, anticipating more transparent and less restrictive regulations under the CFTC. The resignation of SEC Chair Gary Gensler further signals a potential pivot in U.S. crypto policy.

The proposed changes could pave the way for increased institutional participation, fostering growth and innovation within the sector.

Market Impact:

Bullish sentiment from expectations of regulatory clarity.

Potential influx of institutional capital as regulations ease.